- by RingMoney

- 3 min read

We, as Indians, believe that investing your hard-earned money in FD’s and RD’s is the safest option that we could have. Traditionally it’s our mindset that if we are getting our invested sum back along with some return on it and the investment remains safe, then it’s a good investment, though in a way it is. But what we fail to understand is that over a period of time the rate of inflation and interest rate keeps on changing, and so we may be getting our sum back but the purchasing power relatively has diminished.

assume we have taken up investment in FD for a longer term like 5 years, with the rate of interest nearly 5%-6%, and expect that in return we can get approximately Rs.1,27,000 at the end of 5 years, but we don’t realize the inflation rate keeps increasing and this reduces the value of money 5 years from now. Though it’s true that the risk is quite low given the security given by banks as compared to other types of investment products. But if we consider the rate of inflation our real returns would be nearly zero in the end.

Experts are of the opinion that a rise in interest rates would happen but will take due course of time. If interest rates rise, bank FDs would also yield more. But as the credit offtake is slow, banks may not be in a hurry to increase interest rates due amount of retail deposits already available to them. So, for depositors who depend on fixed deposits for their regular income, this is not a good news.

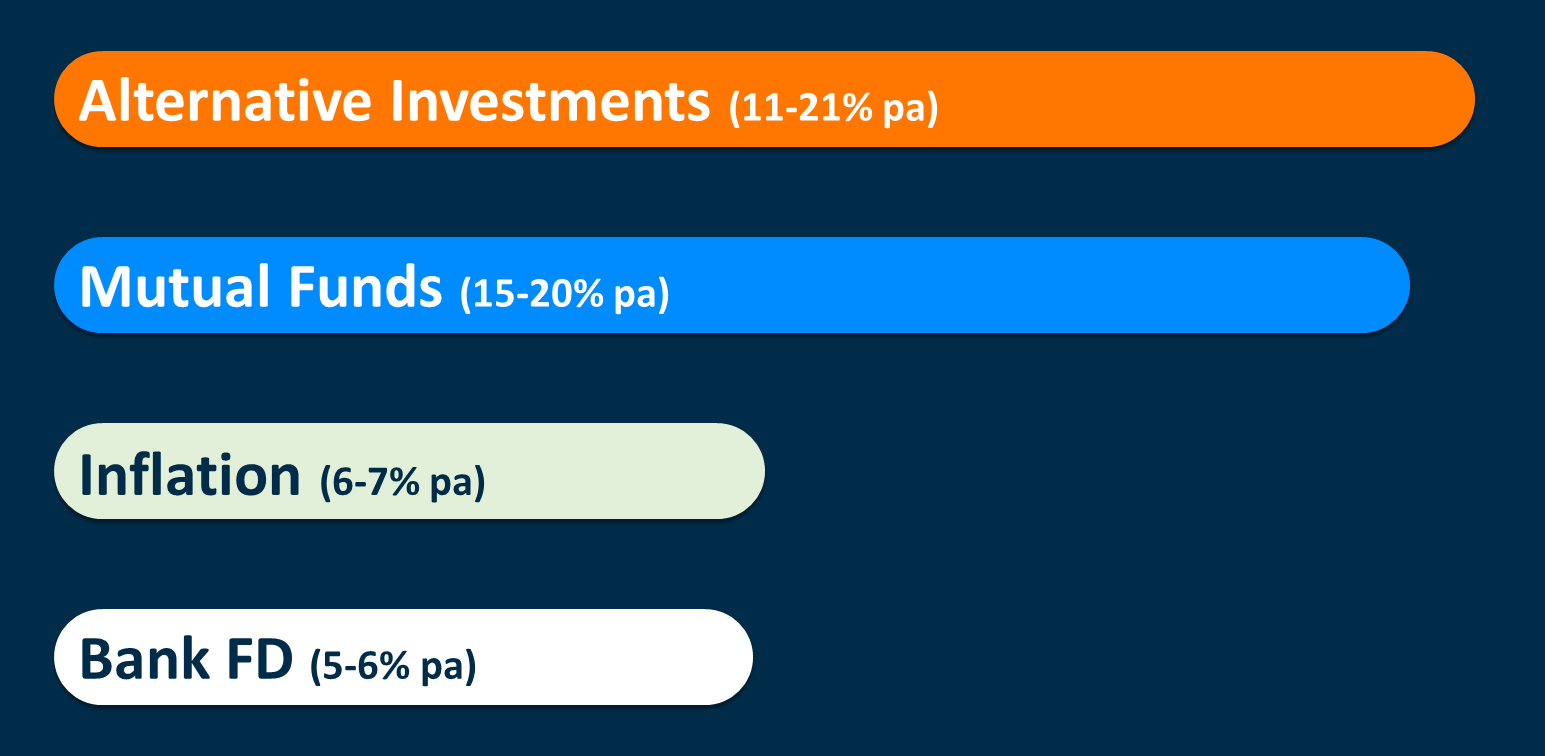

However, there are alternative opportunities available for such investors with some more conventional ones listed for reference

Thus, we can not completely rely on FD’s or RD’s for our investment portfolio. One must consider investing in different types of investment products in order to minimize the risk and maximize the returns. Mutual funds, stocks, global investments, P2P lending, etc. are other options where one can invest and get higher returns. Yes, with higher returns there is higher risk as well, but with the passage of time, FD’s and RD’s are losing their charm (as interest rates are falling leading to lower returns and at the same time inflation rates are rising which sometimes results in negative real returns for bank fixed deposit investments).

Considering other investment options at the right time can be a savior. A well-diversified investment portfolio is capable of providing a better risk-adjusted return than a concentrated portfolio that has only a few types of investment products.