- by RingMoney

- 3 min read

Investing in foreign equities is a new trend that has attracted investors from all around India. There are various advantages to this, one of which is the high return through global diversification

The US stock market might be a smart place to start if you want to diversify your investment portfolio across geographies. And, if you're wondering how to invest in the US stock market from India, you'll be relieved to learn that it's a really basic and straightforward process. From the comfort of your home or office, you can invest in US stocks or trade in any US stock, such as Apple, Google, or Tesla.

With all paper work and bank authorizations covered under one roof, international brokerage platforms ensure that foreign investment is easy, simple, and secure. These foreign brokerage firms provide a one-stop shop for you, from obtaining RBI permissions to locating the appropriate bank account in the United States and opening an account. After you've opened your US stocks account, you'll be able to trade overseas stocks with only a few clicks. The procedure of investing in the US stock market is simple, as brokerage houses handle all of the paperwork with US-based entities.

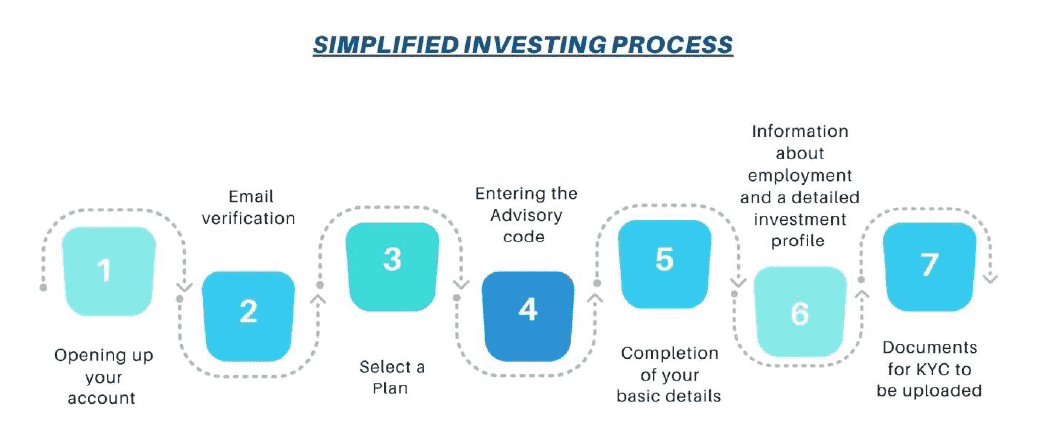

Before you may invest in US stocks from India, you'll need to go through a few crucial steps with a standard investing platform, which could be the brokerage house for international trading :-

First step is to register for an account online once you've found the best brokerage account in India for buying US stocks. It's a straight forward, and quick procedure. To get started, simply enter your name, email address, and phone number.

First step is to register for an account online once you've found the best brokerage account in India for buying US stocks. It's a straight forward, and quick procedure. To get started, simply enter your name, email address, and phone number.

First step is to register for an account online once you've found the best brokerage account in India for buying US stocks. It's a straight forward, and quick procedure. To get started, simply enter your name, email address, and phone number.

First step is to register for an account online once you've found the best brokerage account in India for buying US stocks. It's a straight forward, and quick procedure. To get started, simply enter your name, email address, and phone number.

First step is to register for an account online once you've found the best brokerage account in India for buying US stocks. It's a straight forward, and quick procedure. To get started, simply enter your name, email address, and phone number.

First step is to register for an account online once you've found the best brokerage account in India for buying US stocks. It's a straight forward, and quick procedure. To get started, simply enter your name, email address, and phone number.

For the KYC, you will need two documents: a PAN card to prove your identity, and one of the following to prove your address

i. Driving License

ii. Aadhar card (front and backside of card with number displayed at both the sides)

iii. Latest bank or credit card statement (not more than 3 months old)

iv. Utility bill (not more than 3 months old)

Once above process is completed, it takes 1-2 days for account verification/activation and you are all set for your international investment from the comfort of your home. The investment order could be placed either by the Client or advisor after Client's approval.

You can either do self-investing using your international investment account credentials or may choose advisor who would assist in making market investments.

Feel free to contact RingMoney advisor for further discussion.