- by RingMoney

- 3 min read

Most promising ingredients for an ideal Investment Recipe

Investments have always been a necessity for achieving one’s goals, be it investment of time to achieve ones academic and professional goals or investment of money and wealth for achieving financials goals. Recent pandemic has just made this fact much clearer that only way to achieve one’s goals is through timely and disciplined approach towards investing. Ideal investment should be aimed towards not only the fulfilment of financials goals but also making the resources accessible for the rainy day.

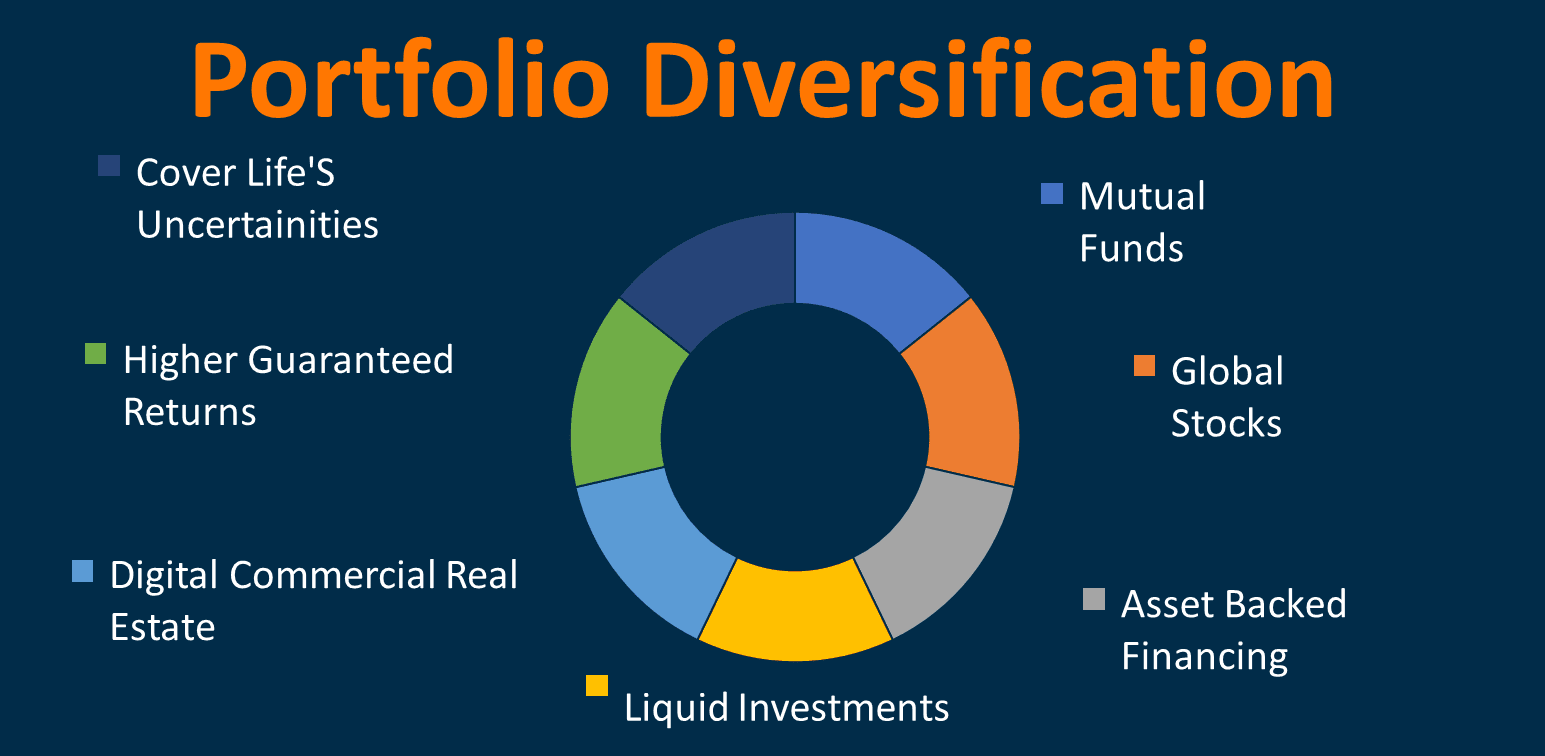

Technological developments have led to unprecedented advances in financial/wealth management space. This has opened up new horizons for making our investments truly customised to our needs by diversifying them geographically (through global funds, crypto currencies, NFTs, etc.) and across asset classes (stocks, bonds, fixed income securities, alternative investments like consumer lending, peer to peer financing, start-up investing, etc.) as well as securing the uncertainties (through Life insurance, Health Insurance, keeping an emergency fund, etc.)

A portfolio having a mix of below mentioned products is expected to be effective under any kind of financial situations, producing better returns than any single product, in the long run.

Equity investments tend to grow in-line with the growth in economy and with Indian Economy poised for a robust growth all along this decade (getting the required regulatory push from 5 trillion economy dream of the ruling government), equity investments in sectors like Banking, Financial Services and Fintech (BFSF), Infrastructure, Technology, Logistics, etc. is expected to grow at a supernormal rate. Also, the prominence that Healthcare and Pharma (pandemic and post pandemic effect) as well as EV/Automobile sectors (innovation and policy support like Vehicle scrappage policy) have received in past couple of years is expected to continue in the foreseeable future.

Fixed Income Investments including Bonds, Consumer Lending, Lease Financing, etc. have become much more accessible to retail investors than few years earlier. Consumer lending/ Lease financing have been two prominent products that have come up in a big way providing higher return potential at relatively lower risk. RBI’s retail direct platform has been an initiative directly from the Central Bank to boost participation of retail investors in RBI, Central/State Government and SGBs (Sovereign Gold Bonds). Emergence of other players providing access to Corporate Bonds and NCDs on their simple, secure and reliable platforms have pushed fixed income investors to look beyond Bank FDs. A generous proportion of these investment products makes the investment portfolio more resistant against any unforeseen conditions.

Salt is one ingredient that brings out the true flavour of a recipe. Likewise, an investment in ‘High Earning Liquid Products’ brings out the key features of a portfolio. An allocation made for a liquid investment (with the ability to withdraw funds whenever required) not only provides the essential support for hard times but also ensure availability of funds to desired investment products whenever the right opportunity comes. Icing on the cake, these high earning liquid products options brings along an returns that are 2-3 times that of a bank saving account (having similar features)

Stabilization of an investment portfolio has to be substantiated by the high growth components in order to make the portfolio effective against inflationary pressures of current times. And there seems to be no better option than the tried and tested Equity Mutual Funds (MFs). Looking at historical returns over long term (8-10+ years), Equity MFs have consistently delivered 10%+ returns. Alongside these investments provide high flexibility in terms of entry and exit points so as to improve the customization level to cater to individual goals. Multiple options based on market capitalization (Large, Medium, Small and Multi Caps) or sector/thematic preference (Banking, IT, Auto, Infra, etc.) as well makes these investments the most sought after.

A few years ago, it was a distant dream for somebody in India to invest in Global names like Microsoft, Amazon, Google, Netflix, etc. These are the names that defined the growth in global landscape over last couple of decades. However, couple of years back, few investment players started working towards making Global Investments available to Indian investor and today we can invest in 4000+ global stocks, funds and investment products right from the comfort of our couch. An account created on such global investment platforms is the most simple and secure way of accessing and adding geographical diversification and growth to our investment portfolio.

A good investment portfolio is worth much more if it can take care of us and our loved when financial assistance is needed the most. And that brings to one of the most important investment components: Insurance. Critics may argue that Insurance is not an investment product, but we believe that insurance is one of the most important investments anyone makes in his life, simply because it makes sure that all other investments could be put to proper use for which they are meant and should not be diverted due to life’s uncertainties. Recent pandemic has just strengthened this long-standing thought. Thus, allocating a proper amount to cover one’s insurance requirement should be compulsory and what better to start with than the two most precious things in one’s life: Life itself and one’s Health.

GIPs offered by multiple players like Max Life Guaranteed Income Plans and Aditya Birla Sunlife Insurance Guaranteed Income Plans provide multiple options for investors to align their investments with their life goals. Once invested with these investment products, investor could be rest assured to achieve the goals more comfortably as these investments provide guaranteed returns based on the opted product.

Recent times have become much more rewarding for Investment community with Academia and Businesses collaborating to ensure availability of better products and services. We have been working alongside the esteemed members of RingMoney family for last couple of years, driving above investment philosophy, making their financial decisions more informed and customized to their investment needs... the comfort and faith of investors makes this a Happy and Growing Family.

Please feel free to reach out to us for any queries. We are just a call/click away...

Happy Investing..